Several U.S. House of Representatives Republicans have proposed legislation that would significantly decrease funding for the Internal Revenue Service (IRS). The move comes after the newly elected Speaker, Kevin McCarthy, stated that he would challenge the funding granted to the U.S. tax agency in the previous year.

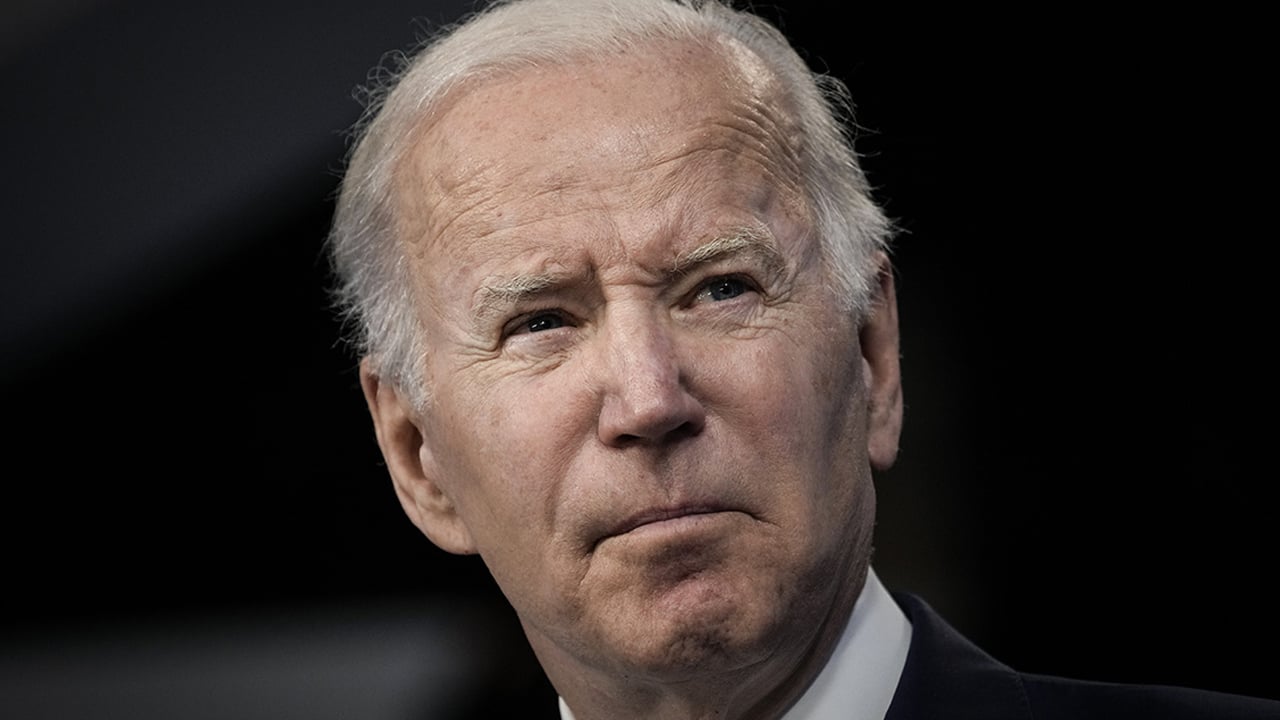

Biden Administration Opposes Bill for Rescinding Funding for IRS Enforcement of Tax Laws

After Kevin McCarthy, the speaker of the United States House of Representatives, announced his intention to repeal the tens of billions in funding that was approved for the Internal Revenue Service (IRS) last year, House Republicans voted on a bill that aims to eliminate the federal income tax and replace it with a “Fair Tax” and a national consumption tax that would be collected by each state. The bill is called the “Family and Small Business Taxpayer Protection Act” and it calls for a “rescission of certain funds made available to the IRS.”

The H.R. 25 bill, also known as the Fair Tax Act, was co-sponsored by representative Earl L. “Buddy” Carter (R-GA). “Instead of adding 87,000 new agents to weaponize the IRS against small-business owners and middle America, this bill will eliminate the need for the department entirely by simplifying the tax code with provisions that work for the American people and encourage growth and innovation,” Carter рекао in a statement. “Armed, unelected bureaucrats should not have more power over your paycheck than you do.”

Извештаји indicate the proposed legislation is not supported by Демократе, who currently control the Senate. Furthermore, the White House has stated that U.S. president Џо Бајден will veto any bill that aims to defund the Internal Revenue Service (IRS). The Biden administration’s изјава emphasizes that the “bill would rescind funding passed in the Inflation Reduction Act (IRA) that enables the IRS to crack down on large corporations and high-income individuals who cheat on their taxes and evade the taxes that they owe under the law.”

The White House added:

If the president were presented with H.R. 25 – or any other bill that enables the wealthiest Americans and largest corporations to cheat on their taxes, while honest and hard-working Americans are left to pay the tab – he would veto it.

Meanwhile, the Internal Revenue Service (IRS) is preparing to have a new commissioner run the tax agency, and Извештаји indicate that it will likely be Danny Werfel. The news also follows statements from the acting special agent-in-charge of the IRS-Criminal Investigation’s New York office, who рекао “cryptocurrency is here to stay.”

In recent times, American crypto advocates have been plagued with anxiety over the advent of a new tax reporting requirement that will necessitate digital currency exchanges, Venmo, Cash App, PayPal, Airbnb, and eBay sending 1099-K forms to their users. The IRS, with its unyielding gaze, has set its sights on payments of $600 or more for goods and services received through a third-party payment network.

The IRS knows if you gave your brother $600 but still can’t tell us how Nancy Pelosi became a millionaire. None of it makes sense

— 🇺🇸Travis🇺🇸 (@Travis_in_Flint) Januar 3, 2023

U.S. lawmakers want Americans to believe that the $600 rule and the deployment of 87,000 new IRS agents is a concerted effort to combat the nefarious billionaire tax evaders and mega-corporations. However, many Americans are not so easily swayed, and believe that this added enforcement and the $600 rule is nothing but a preposterous ploy aimed at the common man.

The IRS audits the poor 5 times the rate of the rich.

87,000 new IRS agents aren’t for billionaires.

They are for $600 Venmo transactions.

— Julio Gonzalez – juliogonzalez.com (@TaxReformExpert) Januar 10, 2023

Advocating for Abolition of the IRS: A Repeated Idea by Various Proponents

The bill is not the first time Republican officials have discussed abolishing the IRS. On Oct. 30, 2022, the U.S. senator from Texas, Ted Cruz (R-TX), tweeted “Abolish the IRS!” and поновљен the sentiment earlier this week.

Abolish the IRS!

— Сенатор Тед Цруз (@СенТедЦруз) Октобар КСНУМКС, КСНУМКС

Former representative Ron Paul, R-Texas, has заговарали for shutting down the IRS on many occasions. Paul верује the IRS is intrusive and that it violates privacy rights by requiring individuals and businesses to disclose personal financial information. He has advocated for a flat tax or a national sales tax as an alternative to the current income tax system.

The late American economist, historian, and political theorist Murray Rothbard also тврде that the IRS represented a violation of property rights and an illegitimate use of government power. Rothbard wrote extensively на тему, and in his view, the IRS, as an enforcement arm of the state, was a tool of coercion and oppression and therefore must be abolished. Meanwhile, as far as the Fair Tax Act is concerned, Rep. Bob Good (R-VA), рекао he supports the Fair Tax “because it simplifies our tax code.”

“This transforms the U.S. tax code from a mandatory, progressive, and convoluted system to a fully transparent and unbiased system which does away with the IRS as we know it,” the Virginia representative added.

What do you think about Biden saying that he would veto the Fair Tax Act? What impact would the elimination of the IRS and implementation of the Fair Tax Act have on the U.S. economy? Share your thoughts in the comments section below.

Кредити за слике: Схуттерстоцк, Пикабаи, Вики Цоммонс

Одрицање од одговорности: Овај чланак служи само у информативне сврхе. То није директна понуда или прикупљање понуда за куповину или продају, или препорука или потврда било ког производа, услуге или компаније. Битцоин.цом не пружа инвестиционе, пореске, правне или рачуноводствене савете. Ни компанија ни аутор нису директно или индиректно одговорни за било какву штету или губитак проузрокован или наводно проузрокован или повезан са употребом или ослањањем на било који садржај, робу или услуге поменуте у овом чланку.

Source: https://news.bitcoin.com/biden-vows-to-veto-house-republicans-fair-tax-act-proposing-elimination-of-irs/