- Bitcoin fell to a two-year low following the collapse of FTX and this led to a decline in investors’ conviction

- Long-held BTCs are moving addresses

With the general cryptocurrency market taking a stab at recovery following the collapse of FTX, on-chain data seems to suggest that long-held Битцоин [БТЦ] has started to see some activity.

Читати Предвиђање цене биткоина [БТЦ]. 2023-2024

In light of favorable macro factors, when long-held crypto-assets change hands, this usually indicates that dormancy on the coin’s network is starting to dissipate and a significant price rally is imminent.

However, in the current market, a closer look at on-chain data revealed that investors’ decisions to move previously dormant BTC coins were borne out of fear and lack of conviction.

Old hands awakening

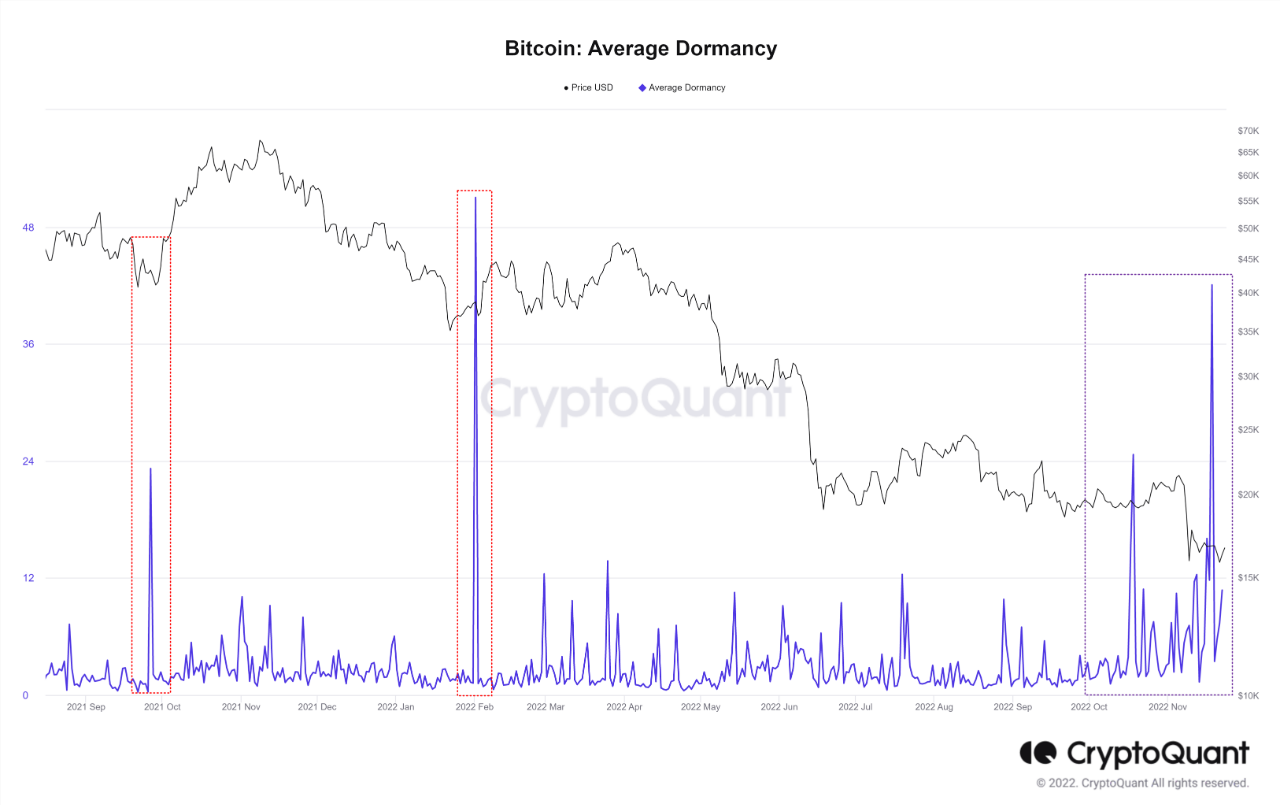

Према аналитичару ЦриптоКуант-а Wenry, BTC’s Average Dormancy is at its highest level since February. This metric measures the average period that every coin remains dormant from the time it was last traded. A spike in this metric indicates a rally in coin distribution.

Wenry noted that in the past, this metric usually rose “during the first technical rebound after a large price drop.” BTC traded at a two-year low due to the collapse of FTX and it has since attempted to recover. However, before this could be taken as conclusive proof of a first “technical rebound,” Wenry warned,

“If $BTC, which has not moved for a long time for a few days, moves and there is a stronger movement in the corresponding indicator in the future, it is judged that it is necessary to focus more on risk management from a trading perspective.”

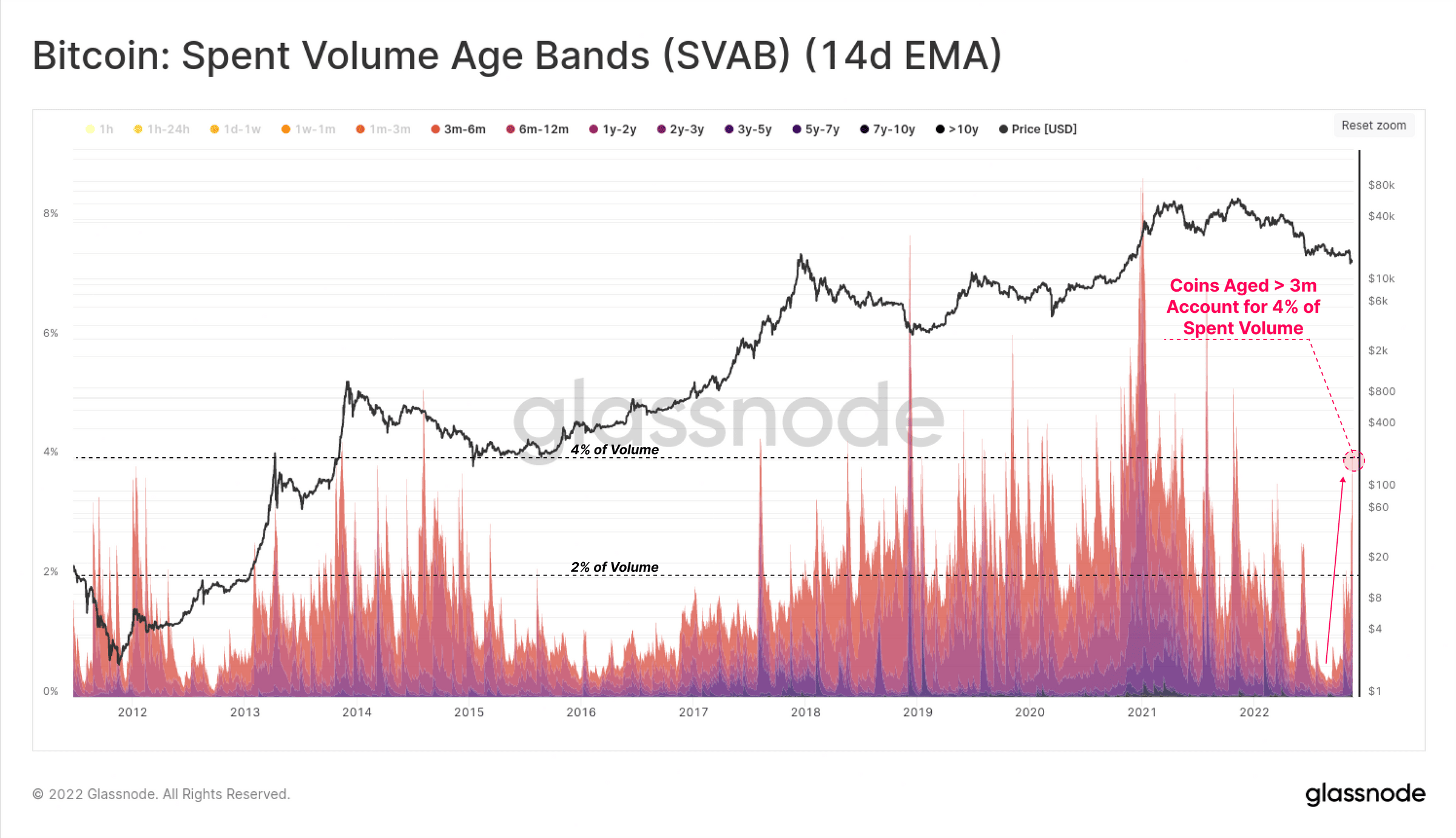

Also, Glassnode, in a new извештај, found that BTC’s Spent Volume Age Bands (SVAB) hit their highest level since the beginning of the year. The SVAB metric revealed that just 4% of all coins spent last week were sourced from coins older than three months. According to the on-chain analytics platform,

“This relative magnitude is coincident with some of the largest in history, often seen during capitulation events and wide-scale panic events.”

Glassnode further observed that uncertainty permeated the minds of BTC long-term HODLers. The same, it said, has been “prompting the changing of hands, and/or shuffling of coins by longer-term investors.”

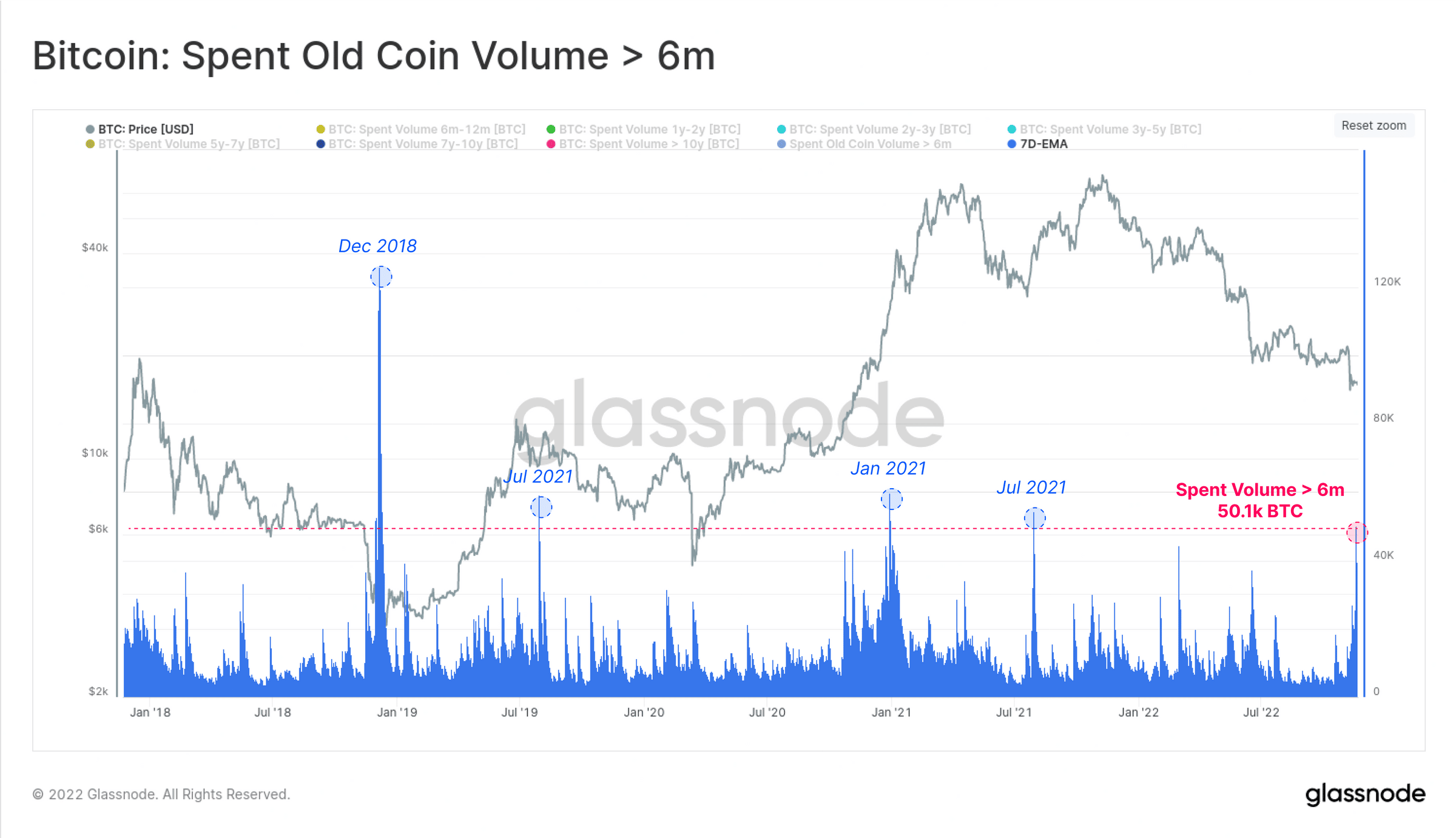

Finally, an assessment of BTC’s Spent Old Coin Volume older than 6 Months revealed that the metric hit its fifth-highest value in the last five years.

“In the time since FTX collapsed, a total of 254k BTC older than 6-months have been spent, equivalent to around 1.3% of the circulating supply. On a 30-day change basis, this is the steepest decline in older coin supply since the Jan 2021 bull run, where long-term investors were taking profits in the bull market.”

It is, however, too soon to say how these observations across datasets will affect Bitcoin’s value on the charts going forward.

Source: https://ambcrypto.com/bitcoin-btc-some-conviction-and-a-lot-of-changing-hands-is-a-sign-of/