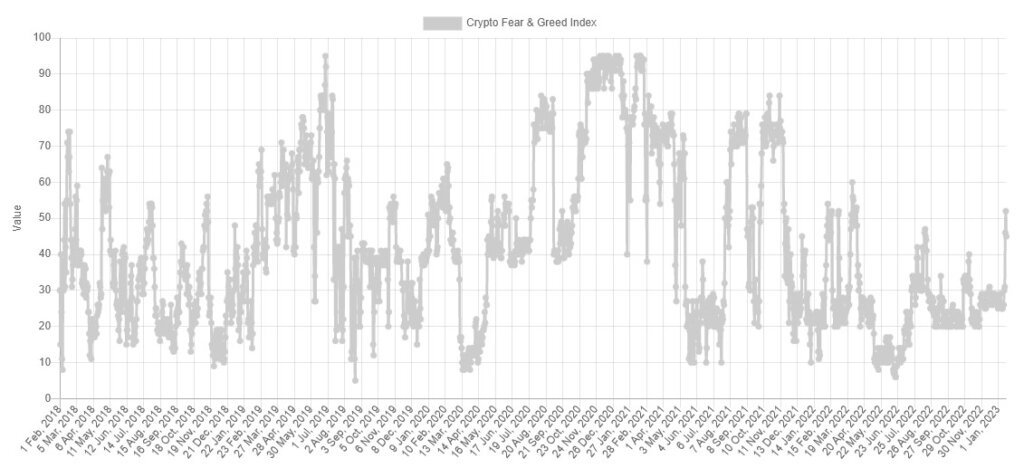

По први пут од априла 2022. године, индекс биткоин страха и похлепе (ФГИ) прешао је из зоне „страха“ у „неутрално“.

Током викенда, Битцоин је достигао резултат од 52 на индексу док је Битцоин прешао преко 21,000 долара.

У време штампе, оцена се благо повукла до доњег краја скале „страха“ са рејтингом од 45. Индекс је започео годину у зони „екстремног страха“, што указује да је медвеђа расположења имала контролу над тржиштем на почетак јануара.

Међутим, како се Битцоин попео са распона од 15,600 до 17,200 долара одржаног током новембра и децембра, ФГИ се удаљио од екстремног страха.

Bitcoin went into free fall following the collapse of FTX. However, it appears to have recovered to pre-FTX-collapse levels within the past week. The top cryptocurrency by market cap was range bound for roughly 63 days before breaking resistance to break back above $20,000.

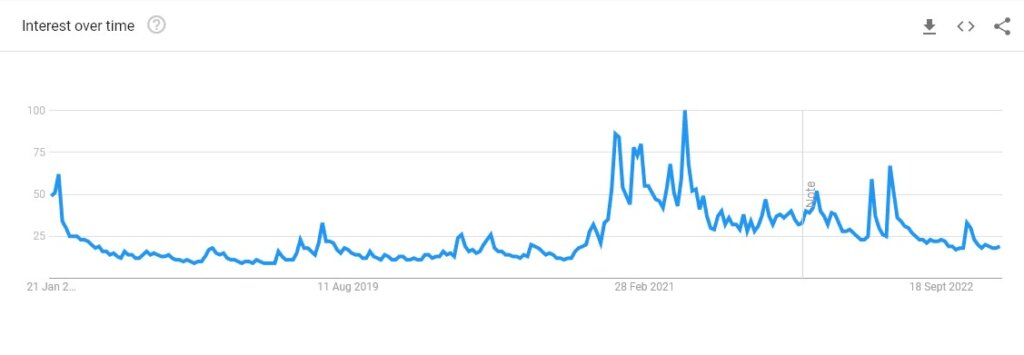

Furthermore, while the FGI may have moved away from ‘fear,’ other global metrics have not shown a similar bullish trend. For example, Google search traffic for the term ‘Bitcoin’ is still at its lowest since December 2020.

Interest by region shows El Salvador as the most interested in Bitcoin by some margin, with Nigeria following behind before a large gap before European countries such as Netherlands, Switzerland, and Austria.

Bitcoin is legal tender in El Salvador, while Nigeria utilizes BTC for peer-to-peer payments.

Nigeria recently признат crypto as an asset class alongside its CBDC, the e-Naira. However, Paxful CEO Ray Youssef attributed the rise in Bitcoin’s popularity to Nigeria’s youth culture by stating:

“Nigeria is different, the youth were all about it, they were like bring in the Bitcoin, screw everything else let’s do this.”

Aside from these outlier nations, interest in Bitcoin has undoubtedly waned during the bear market, and the recent rally has not led to a considerable increase in Bitcoin searches globally.

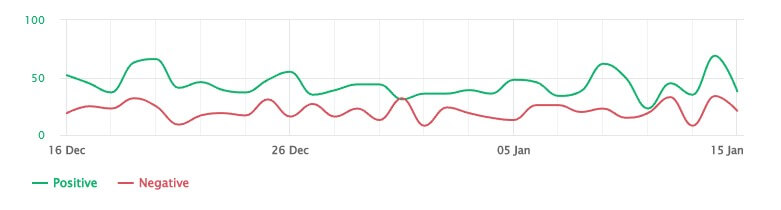

Additionally, a review of sentiment analysis for popular videos, news, and blogs related to Bitcoin showed a peak in positive sentiment on Jan. 15. However, there has been no apparent increase in either positive or negative views over the past 30 days.

Looking at the historical FGI data, it is clear that Bitcoin has broken the downward trendline which started in November 2021. However, other breakouts were supported by increased interest in Bitcoin, which is not evident as of press time.

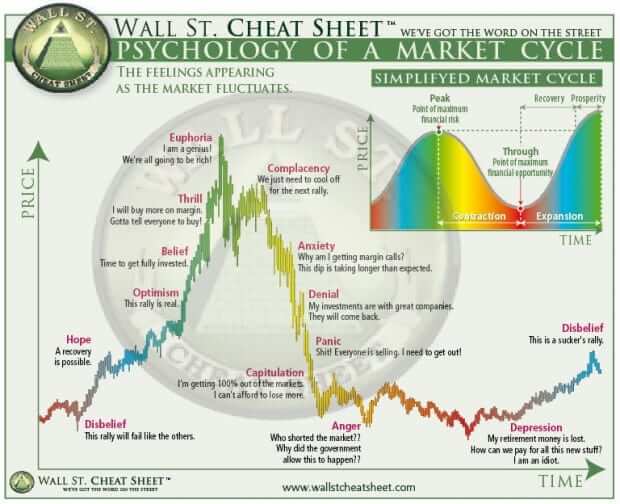

Potential negative catalysts remain at the forefront of investors’ minds as Digital Currency Group has failed to publicly sure up its business. As a result, the risk of further pain in the market remains high, with many pointing to the recent price action as indicative of a bull trap.

However, Alistair Milne, chief investment officer at Altana Digital Currency, shared a popular graph that depicts the typical investor mentality at each stage of a price cycle. In the image shown below, the final stage of a bear market is described as ‘disbelief.’

Following the ‘disbelief’ phase, the market moves back into the bull territory.

Such images are far from 100% accurate as there is no crystal ball to predict Bitcoin’s price. However, with falling inflation and little over one year until the next Bitcoin halving, there is finally some reason to hold out hope of a faster-than-expected return to the bull cycle.

Source: https://cryptoslate.com/bitcoin-moves-toward-neutral-sentiment-on-fear-greed-index/