Објављено пре 5 секунди

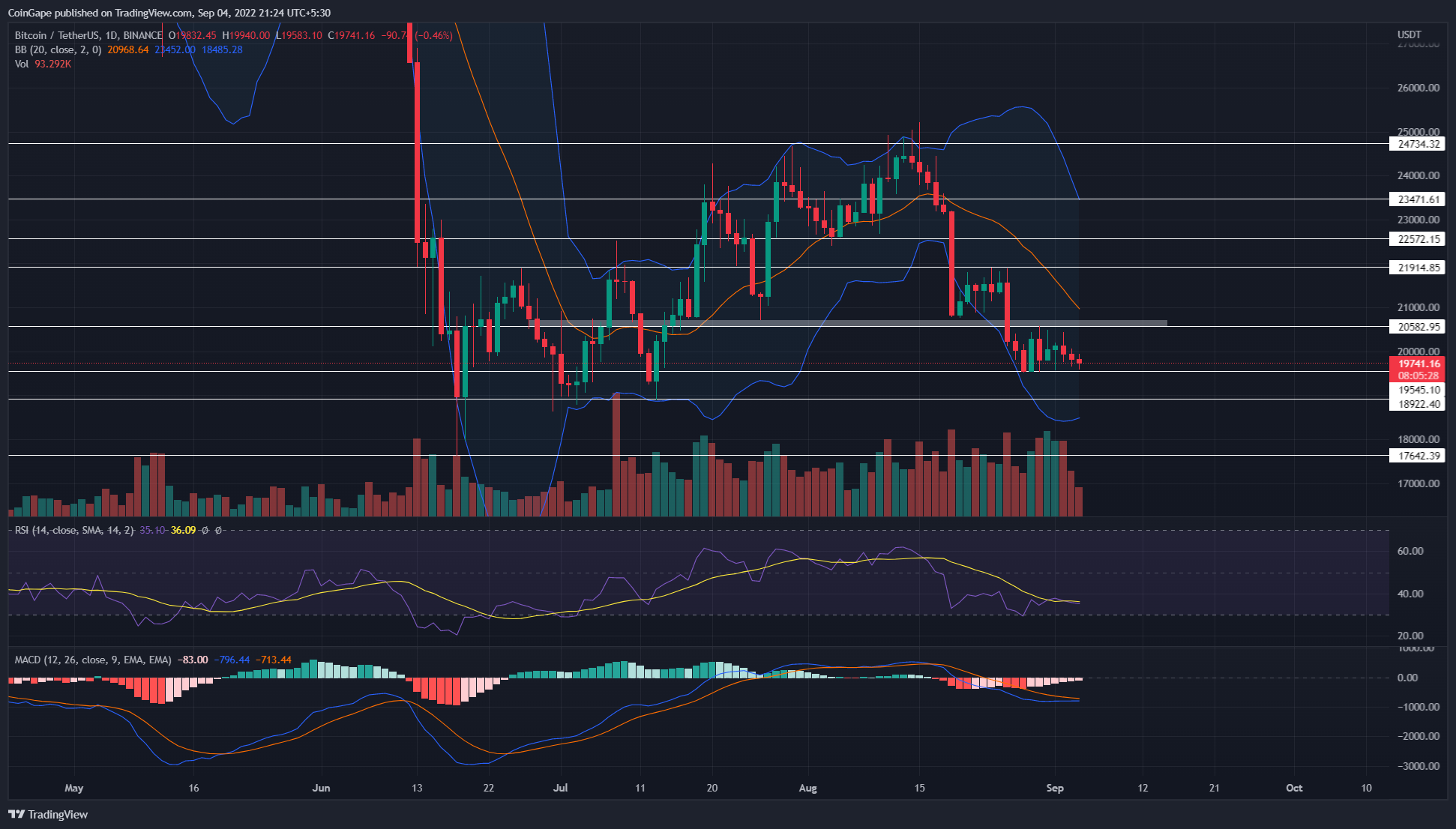

Today, the Bitcoin price is trading at the $19723 mark and had earlier retested the weekly support of $19500. The long tail-rejection attached to the daily candle back by decreasing volume increases the likelihood of bullish reversal. Can the potential bull run reclaim the $20600 mark?

Кључне тачке из анализе цена биткоина:

- The BTC buyers obtained significant support at $19550

- The Bitcoin price action remained trapped in a narrow range

- Унутардневни обим трговине биткоинима је 24.3 милијарди долара, што указује на губитак од 13.5%

Извор-Традингвиев

Извор-Традингвиев

Following the August second-half sell-off, the Битцоин цена plunged to $19500 support and initiated a consolidation phase. This downfall has offset around 75% of gains recorded during the June to early august recovery and plummeted the prices by 22.5%.

Earlier this week, the Bitcoin price attempted to recover higher but failed to surpass the nearest resistance of $20750. As a result, the coin price entered a narrow consolidation between the $20750 and $19500.

Furthermore, the failed attempt mentioned above slumped the BTC price back to the $19500 mark. However, the decreasing volume during this bearish reversal reflects that the seller’s hand is weakening as we approach the lower support.

Such volume activity with a long lower price rejection indicates a higher possibility for a bullish reversal. Thus, if the buyers pierce the $20750 resistance, the Bitcoin price may witness a longer relief rally before continuing the bear trend.

A bullish reversal may surge prices by 10.5 or $14.5% to hit the $21900 or $22600 resistance, respectively. However, a bullish breakout above $22600 would weaken the bearish momentum and bolster buyers for a $25000 breakout.

On the flip side, if the Bitcoin price took an immediate reversal from the $20750 resistance, the consolidation range would extend longer and possibly breach the lower support.

A breakdown below $19500 will prolong the correction phase to $18865 or $18000.

Тецхницал Индицатор

Болингерова трака: the coin price trading quite below the middle line reflects an aggressive selling in the market. Moreover, a possible reversal may face dynamic resistance from this midline.

РСИ индикатор: Биковска дивергенција у дневни-РСИ slope bolsters price reversal from the $19500

МАЦД индикатор: the fast and slow slope drawn close to each other displays the buyers’ attempt to regain trend control. A potential биковски прелаз between these will encourage the $20750 breakout.

- Ниво отпора - 207501 и 22000 долара

- Ниво подршке - $19550 и $18865

Представљени садржај може садржати лично мишљење аутора и подложан је тржишним условима. Истражите тржиште пре него што инвестирате у крипто валуте. Аутор или публикација не сноси никакву одговорност за ваш лични финансијски губитак.

Source: https://coingape.com/markets/bullish-rsi-divergence-hints-10-relief-rally-in-bitcoin-price/