Глассноде податке анализира ЦриптоСлате показује да рудари биткоина почињу да уживају у одређеном предаху у текућој години након што су имали муке у 2022.

Bitcoin miner’s holdings decline 12.1% YoY

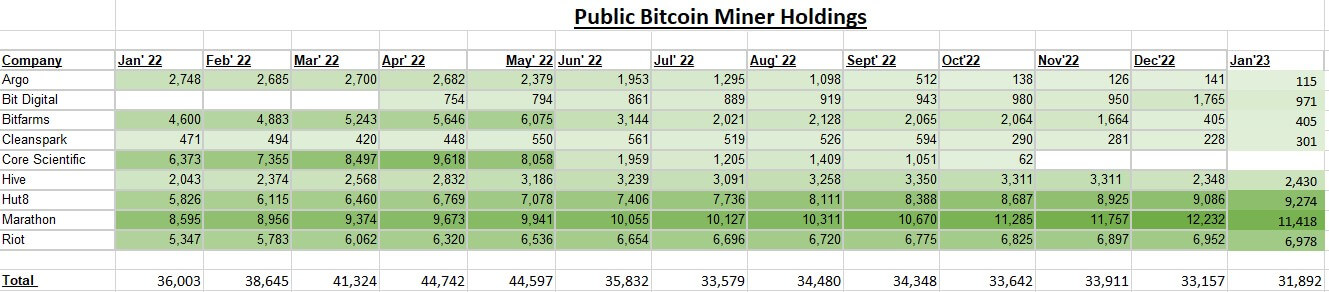

Од јануара 2022. рудари биткоина држали су 36,003 БТЦ, а рударске фирме као што су Цоре Сциентифиц, Риот, Хут8, Маратхон и Битфармс држе преко 30,000 новчића.

Међутим, изгледа да се пејзаж променио у текућој години пошто су Хут 8, Маратхон и Риот сада доминантни рудари, држећи 87% — 27,760 БТЦ — БТЦ имовине рудара, према ЦриптоСлате'с истраживање.

Битфармс и Цоре Сциентифиц су пали док су се борили 2022. године — овај други је поднео захтев за стечај док су се први бавили дужничке обавезе.

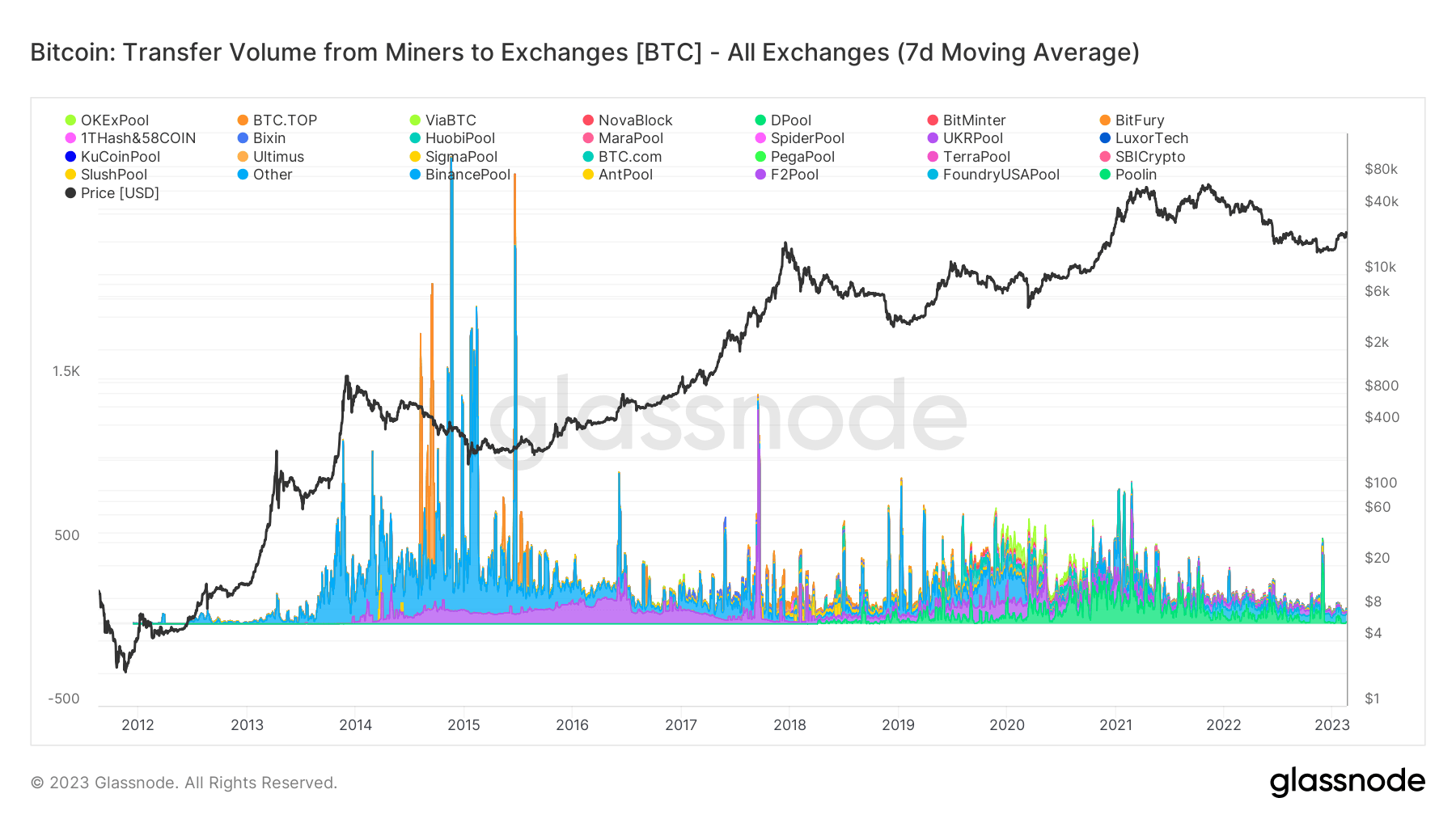

Meanwhile, the market has seen a little BTC distribution from miners in January 2023 compared to the previous year.

Осим тога, акција of several miners have risen by three figures on the year-to-date (YTD) metric. Miners like Hut8, Riot, Iris, Marathon, etc., have all seen their shares increase by over 100% YTD.

Miners are selling their BTC to exchanges at “extremely low levels”

ЦриптоСлате'с analysis showed that miners appear to be in a healthier position compared to the previous year.

According to Glassnode’s data, as analyzed by ЦриптоСлате, miners are selling their BTC to exchanges at extremely low levels compared to previous years.

То је зато рентабилност is beginning to return to the mining industry as BTC’s price has risen by around 50% in 2023 — the flagship digital asset briefly traded above $25,000 for the first time since August 2022 on Feb. 16.

Meanwhile, Bitcoin hash rate ружа 34% on the year-on-year metric and hit a new all-time high of 300 TH/s. This shows the network’s current consistency and strength.

Mining BTC is currently cheaper

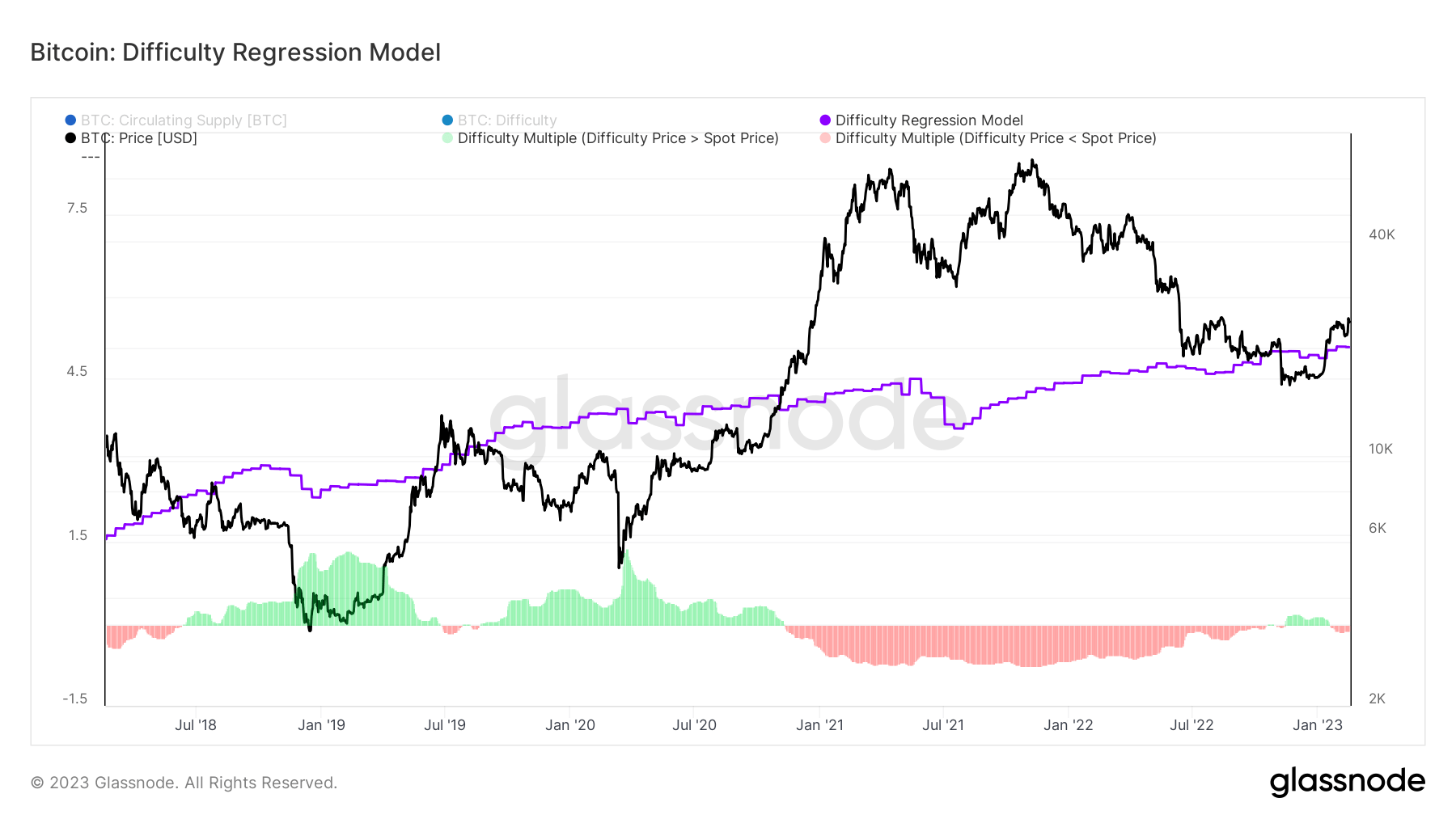

The Difficulty Regression Model, a metric used to measure the cost of mining Bitcoin, is currently under the asset’s spot price.

According to the chart above, the DRM is at $20,000, more than $4000 below BTC’s current spot price at the time of writing.

The current DRM level is essential for the miners to hold as it ensures that they are in an excellent financial position even if the hash rates continue to soar and the mining difficulty rises.

Meanwhile, the DRM could also be used to gauge bear markets sentiments when BTC’s price falls under the DRM.

Source: https://cryptoslate.com/research-public-bitcoin-miners-in-better-financial-health-despite-12-1-yoy-drop-in-btc-holdings/