A macro analyst at a $3.3 trillion investment firm says the days of Bitcoin (BTC) skyrocketing over 1,000% and then crashing 80% are over.

In a new Twitter thread, Fidelity executive Jurrien Timmer каже his 107,700 followers that the wild price discoveries that BTC went through during its previous bull markets are likely a thing of the past as institutional investors adopt the leading crypto asset.

“Until recently, Bitcoin would often overshoot its intrinsic value to the upside during bull markets and to the downside during bear markets. It was a momentum game with little to no resistance, until the trend reached exhaustion.”

Timmer says that Bitcoin is now following a demand curve based on network growth or the rise in the number of users flocking into BTC.

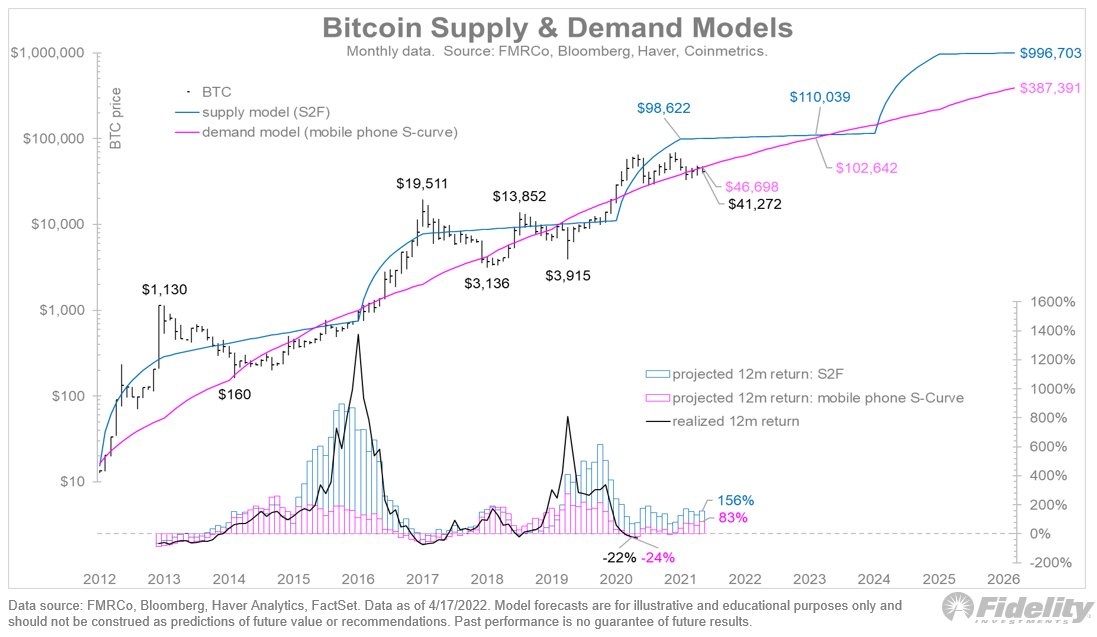

“Is the efficient market hypothesis replacing the go-go price discovery of yesteryear? The chart [below] shows Bitcoin’s fundamentals. The supply curve is dictated by the S2F model (stock-to-flow), and the demand curve is driven by network growth (Metcalfe’s Law)…

In recent months the price of Bitcoin has stopped tracking the S2F model and has instead hugged the pink line (demand model). That makes sense to me.”

According to Timmer, the demand model makes Bitcoin an efficient two-way market where investors accumulate BTC during price corrections and efficiently unload BTC when the asset rallies.

“As Bitcoin’s value becomes better understood by more and more investors, there could be more efficient accumulation when Bitcoin swoons, and more determined distribution when it moons. That’s what makes a two-way market.”

Timmer also says that the entry of bigger investors will likely reshape the future price action of Bitcoin.

“Remember, price is what you pay, but value is what you get. In the early days, most investors only knew the price. But as investors better understand valuation, Bitcoin is less likely to resemble the early boom-bust days and could start behaving like a traditional risk asset.”

Проверити Цена акција

Не пропустите ни један ударац - Пријавите се да бисте добили крипто имејл упозорења која се достављају директно у вашу пријемну пошту

Пратите нас на Twitter, фацебоок Telegram

Сурф Даили Ходл Мик

Изјава о одрицању одговорности: Мишљења изнета у Даили Ходлу нису савети за улагање. Улагачи би требали обавити своју дужну опрему прије него што уложе у високе ризичне инвестиције у битцоин, крипто валуту или дигиталну имовину. Имајте на уму да су ваши трансфери и трговине на сопствени ризик, а за све губитке који могу настати одговоран сте. Даили Ходл не препоручује куповину или продају било које крипто валуте или дигиталне имовине, нити Даили Даили Ходл није саветник за инвестирање. Имајте на уму да Даили Ходл учествује у аффилиате маркетингу.

Истакнута слика: Схуттерстоцк/дигиталарт4к

Source: https://dailyhodl.com/2022/04/24/the-boom-and-bust-days-of-bitcoin-btc-are-over-according-to-fidelity-macro-analyst-heres-why/