On-chain data shows the Bitcoin binary CDD has been going down recently, a sign that selling pressure may be getting exhausted in the market.

Bitcoin 21-Day MA Binary CDD Has Been Observing Downtrend Recently

Као што је истакао аналитичар у ЦриптоКуант-у пост, there was some heavy distribution going on in the market just a while ago. The relevant indicator here is “Цоин Даис Дестроиед” (CDD). A coin day is the amount that 1 BTC accumulates after sitting still in a single address for 1 day.

When a coin that was previously dormant (and was thus carrying some coin days) makes some movement on the chain, its coin days counter resets back to zero, and the coin days it had accumulated are said to be “destroyed.” The CDD metric measures the total amount of such coin days being destroyed across the network on any given day.

When this indicator has a large value, it means long-term holders are possibly moving or selling their coins as this cohort tends to stack up huge numbers of coin days. “Binary CDD,” the version of the metric being used here, tells us whether the supply-adjusted CDD is more or less than the average supply-adjusted CDD.

Сродно читање: Bitcoin Bottom Or More Pain? Here’s What BitMEX Founder Arthur Hayes Thinks

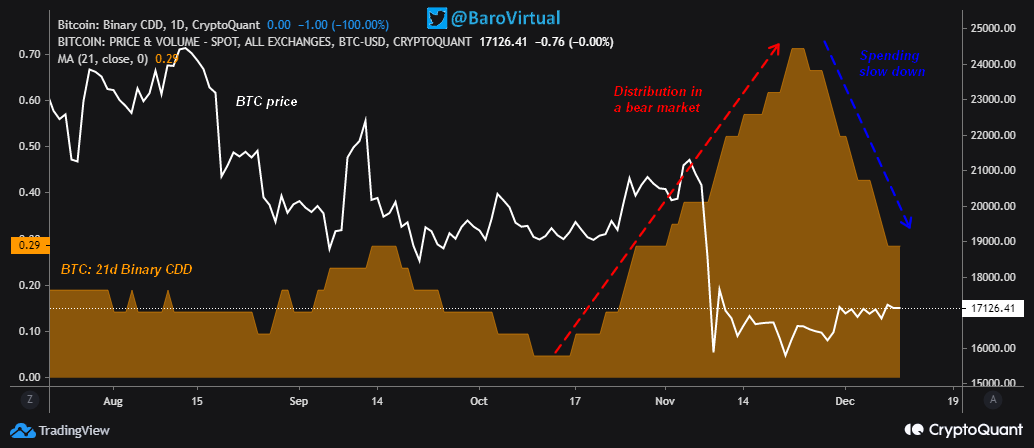

As the name already implies, this indicator can have only two values, 0 and 1. It’s 0 when the Bitcoin CDD is less than the average, while it’s 1 when it’s more. Here is a chart that shows the trend in the 21-day moving average value of this metric over the last few months:

Looks like the 21-day MA value of the metric has been on the way down in recent days | Source: ЦриптоКуант

As you can see in the above graph, the 21-day MA Bitcoin binary CDD had been climbing up between mid-October and late November, suggesting that the long-term holders were dumping. The BTC price took a large hit while this trend was taking place. However, in the last couple of weeks or so, the indicator has been rapidly going down instead.

This could be a sign that the selling pressure that was previously present in the BTC market is now getting exhausted, which is something that can pave way for a дно formation in the price.

БТЦ цена

У време писања, Битцоин цена креће се око 17 хиљада долара, што је пад од 1% у последњој недељи. Током прошлог месеца, крипто је добио 1% на вредности.

Испод је графикон који показује тренд цене новчића у последњих пет дана.

The value of the crypto seems to have dipped down in the last twenty-four hours | Source: БТЦУСД на ТрадингВиев

Source: https://newsbtc.com/news/bitcoin/bitcoin-metric-selling-pressure-reaching-exhaustion/