Одрицање од одговорности: Представљене информације не представљају финансијске, инвестиционе, трговачке или друге врсте савета и представљају искључиво мишљење писца.

- LINK could target its December highs in the next few days.

- Short and long-term HODLers posted profits.

Цхаинлинк [ЛИНК] hit its bottom at the end of 2022, with a value of $5.473. It posted a 30% gain into the new year but was later forced into a $6.617 – $6.924 range. However, BTC’s drop to the $20,000 region tipped bears to break below the range.

At press time, LINK’s value was $6.422, and bulls had thronged to buy it at discounted prices. LINK could target its December high in the next few days, but only if the bullish momentum increased.

Читати Цхаинлинк-ово [ЛИНК] предвиђање цене 2023-24

The December high of $7.682: Can bulls target it?

The 12-hour chart showed a distinct pattern to Relative Strength Index (RSI) movements. Whenever LINK is bullish or bearish, RSI rejection occurs at the mid-range before a successful crossover.

At press time, the RSI faced rejection after retreating from the overbought zone. If the past trend holds, the rejection could see the RSI move to the overbought zone again as buying pressure increased.

Therefore, LINK could target its December high of $7.682, but it must first overcome the hurdles at $6.617 and $6.924. Weak hands could thus lock profits at these hurdles with 10% potential gains. On the other hand, diamond hands could enjoy about 20% gains if LINK hits its December high.

However, bears could breach the current support and push LINK’s value to $6.050, invalidating the above bullish bias. Investors should therefore track BTC movements and FOMC’s announcement at the end of January.

Колико је 1,10,100 LINKS worth today?

LINK’s volume dropped, but HODLers still posted gains

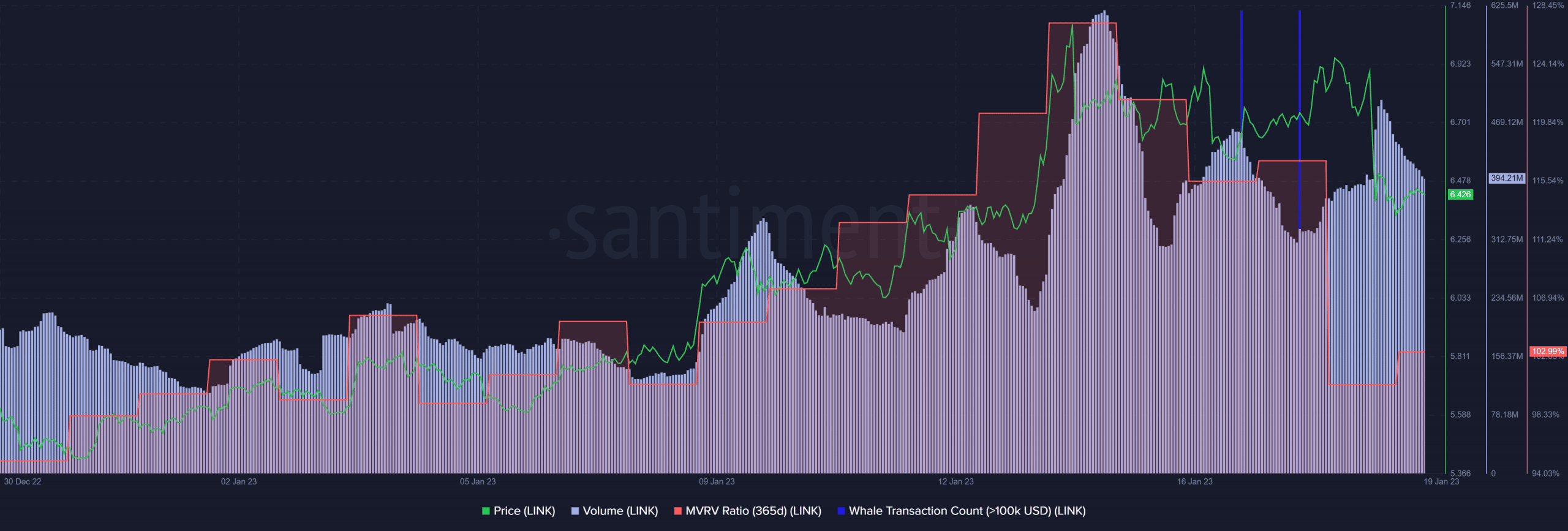

According to Santiment, LINK’s recent price spikes occurred during an uptick in Whale Transaction Count on 16 and 17 January. However, the declining trading volumes undermined further uptrend momentum.

Despite the price decline, short and long-term posted gains as indicated by a positive Market Value to Realized Value (MVRV) ratio. In fact, long-term holders enjoyed over 120% profits recently, which were reduced to 100% at the time of publication.

Source: https://ambcrypto.com/chainlink-link-could-offer-up-to-20-gains-at-these-prices-time-to-sell/