- The DAO wants to reduce the stake interest of OHM.

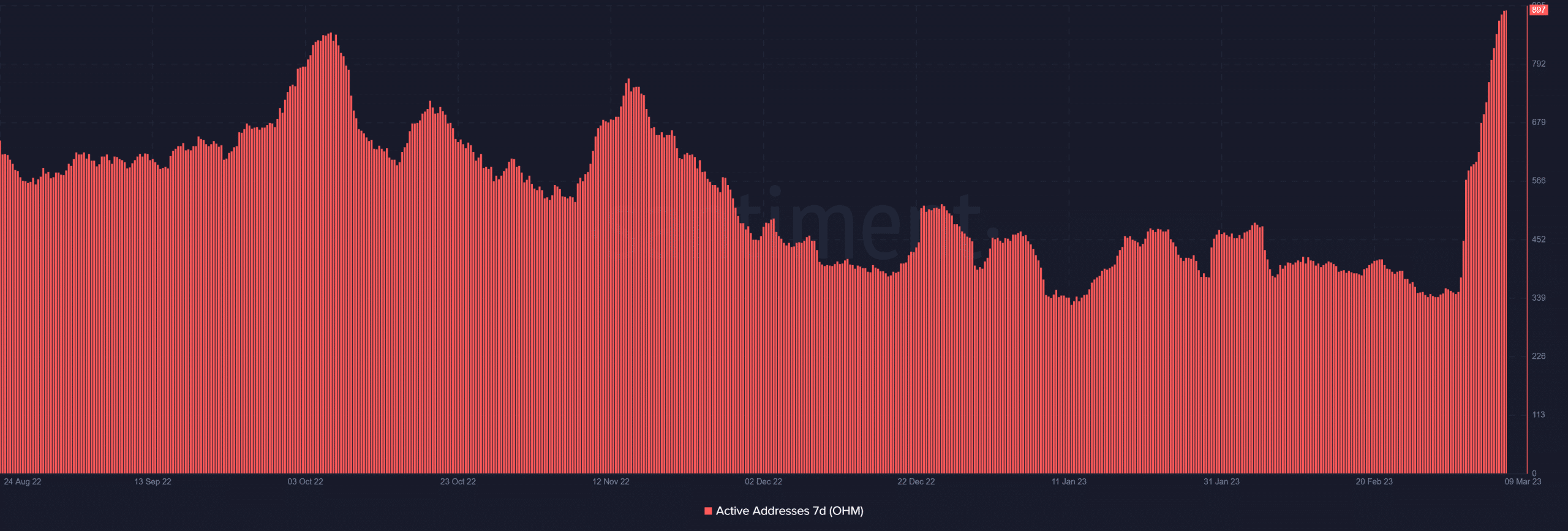

- More addresses have gotten active as the proposal gets ready for community votes.

By putting out a new proposal, ОлимпусДАО is now working toward expanding the utility of its OHM token. With the community set to vote, here’s how key metrics have reacted to the proposal.

Читати OlympusDAO (OHM) Price Prediction 2023-24

OIP 133 presents OlympusDAO’s options

In a post on 8 March, OlympusDAO најавила the launch of a new proposal. The proposal, tagged OIP 133, suggests three potential improvement options to the OHM token’s functionality.

The proposal aims to increase the utility of tokens in circulation and decrease the staking interest on the token.

The first option entails issuing a single OHM bond at a fixed interest rate of 7.33%, with the stake rate gradually or instantly reduced to zero.

In option two, OHM’s staking rate isn’t up for reevaluation until after the completion of loan projects. The third option is a hybrid of the first two, which involves decreasing the staking rate over time as projects are completed.

While over 90% of OHM was staked, at press time, only around 60% of it was used for transactions other than staking.

Active users see an increase

The seven-day active address metric for ОлимпусДАО (OHM) per Santiment revealed that it had previously been declining.

Nonetheless, a clear upward trend has been developing since the beginning of March. With the uptrend, it was at its highest point in more than four months. There were about 899 active addresses as of this writing, a significant increase.

OHM slumps into a strong bear trend

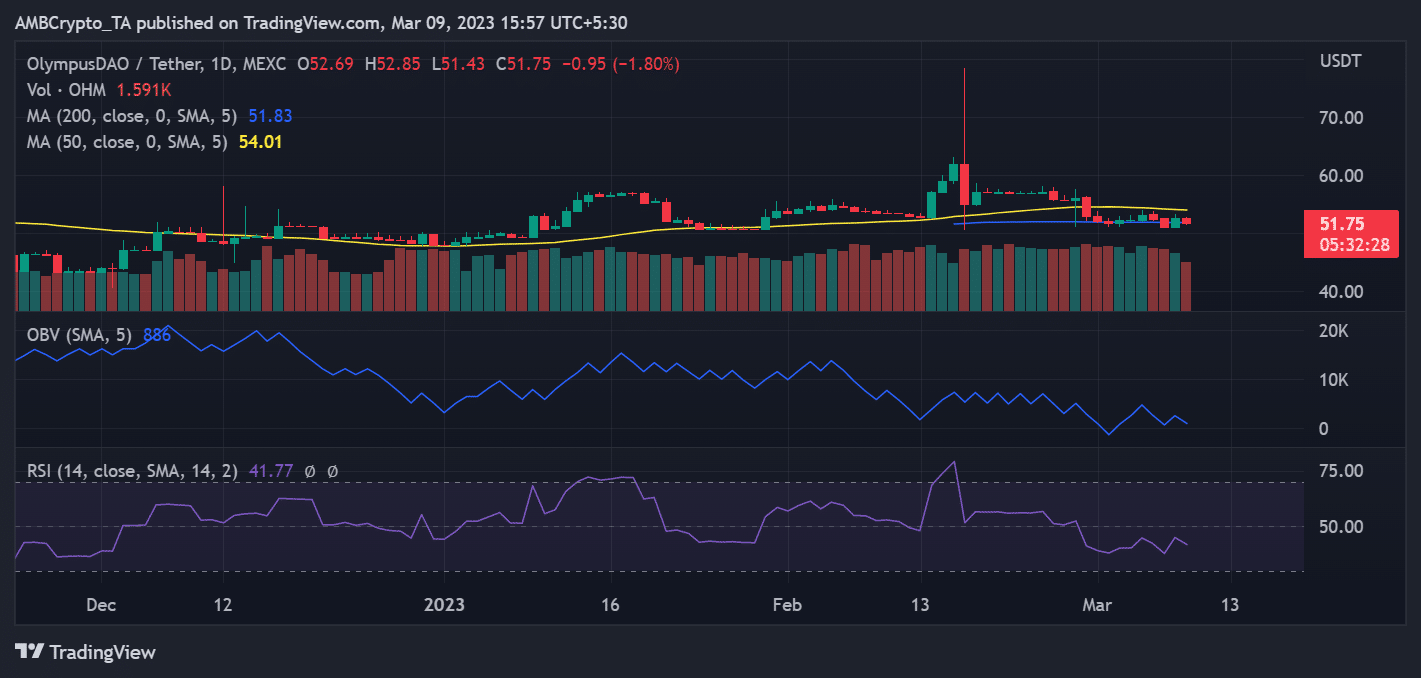

Although the price movement of OHM in March appeared to be flat, there were a few notable value decreases that were noticeable. Before March, however, there had been a mix of ups and downs, and the asset could not maintain its upward trends.

The coin was trading at about $51.7 and had lost more than 1.5% as of this writing on a daily timeframe. The daily volume also demonstrated a lack of noteworthy activity.

The DAO observed low transaction volumes outside of staking, which may be reflected in the current level of volumes.

This asset has remained in a bear trend because of the poor price action. The Relative Strength Index (RSI) line’s position, slightly above 40, confirmed the bearish sentiment.

Реално или не, ево OHM market cap in BTC’s terms

MVRV flips to an undervalued region

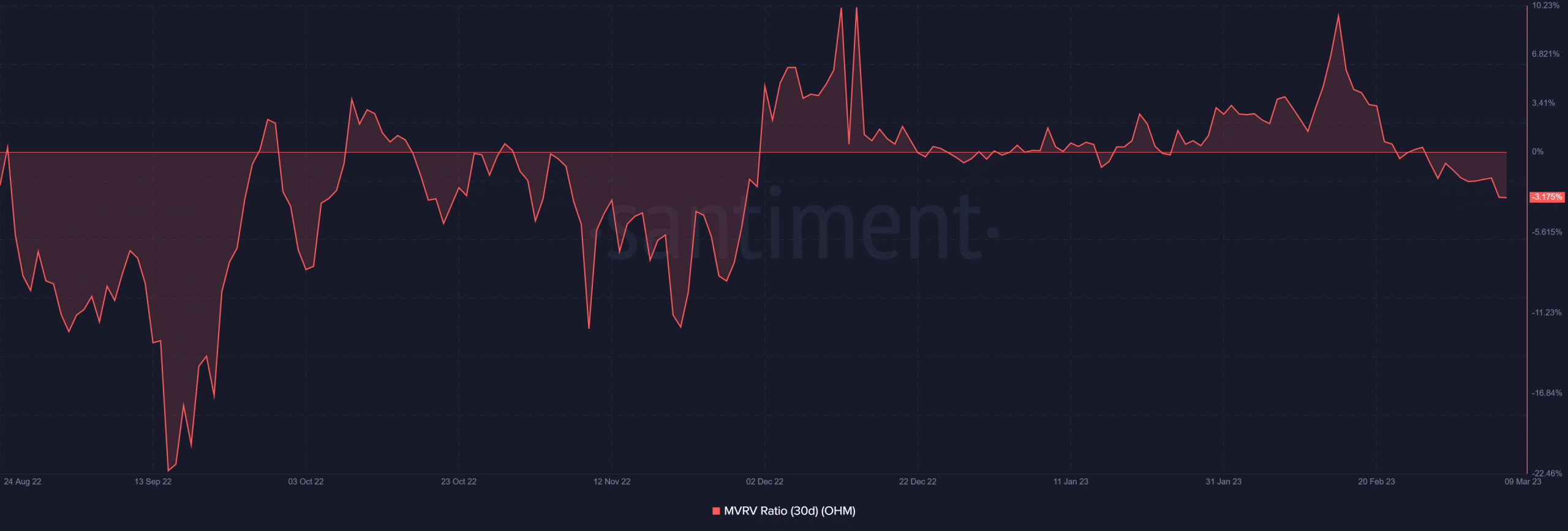

OlympusDAO (OHM) has been battling to maintain its position above the overvalued zone, according to the 30-day Market Value to Realized Value Ratio (MVRV). A further price decline, however, has transformed it into an undervalued asset. It was around -3.1% as of the time of writing.

Source: https://ambcrypto.com/olympusdao-wants-to-bring-more-utility-to-ohm-thanks-to-oip-133/