Hoping for a bear killing October? The month looks ready to kick off with gains, as the stock market appears ready to shake off a few troubling headlines.

Tesla shares are tumbling after not-good-enough quarterly sales, and another crisis may be brewing over the health of a big European bank. But investors seem modestly impressed with efforts by the U.K. government to put out a market fire it started recently.

To be sure, a never-ending supply of crisis headwinds may make the S&P 500

СПКС,

work even harder to find its true bottom. That brings us to our зов дана, from Miller Tabak + Co.’s chief market strategist Matt Maley, who sees Google parent Alphabet

ГООГЛ,

as one of the best oversold names to start buying right now.

He admits that the overall market doesn’t look that cheap yet, while Alphabet faces some headwinds, but its search engine business “is still a monster…with ad sales growth of more than 13% last quarter.”

The stock trades at 17 times forward earnings, and 18 times reported earnings, he notes. “Since the company went public in 2005, it has only been cheaper at the bottom of the Great Financial Crisis and after two dips in 2011 and 2012, during the European crisis of that time (Greece),” said Maley.

Miller + Tabak

So how to do this? Maley suggests buying the Google parent gradually over the coming months, similar to “dollar-cost averaging” — investing a fixed amount in a security or asset on a regular basis, no matter what market are doing.

That strategy works well when companies get cheap and is an excellent one to use during bear markets, “especially after the ‘bear’ has already done a lot damage,” said Maley. But the stock of a good company can get even cheaper before it bottoms, which is why they need to buy gradually — for individual investors that may mean once a month for nine to 12 months.

The average price of Alphabet — down nearly 34% year to date — should look good a year from now and even better in three to five years, because decent names that get tossed out in a bear episode often rally back stronger than the broader market in the years after, he adds.

Note, the strategist is a firm believer that more froth needs to come out of this market, possibly another 15% into the low 3,000s for the S&P 500

СПКС,

The market had gotten too pricey versus the economy, which “had become pushed to a level that it could not maintain without steroids.”

“It has to get back in line with the underlying economy…and the underlying economy has to get back in line the growth it can maintain without artificial liquidity. Don’t fight the Fed,” says Maley.

Прочитајте: After the worst September for stocks since 2002, here’s what October could bring

Тржишта

Резерве

СПКС,

ЦОМП,

are higher, with Treasury yields

ТМУБМУСД10И,

ТМУБМУСД02И,

dropping. The British pound

ГБПУСД,

is hovering at pre-crisis levels and gilt yields

ТМБМКГБ-10И,

are down after the U.K. government’s U-turn over a heavily criticized budget move. Цене нафте

ЦЛ.1,

БРН00,

are surging on hopes for a cartel output cut this week, with gasoline prices

RBZ22,

also shooting higher, but natural-gas prices

НГ00,

превртање.

Зујање

The Organization of the Petroleum Exporting Countries and Moscow-led allies, aka OPEC +, could cut production by more than 1 million barrels a day — the biggest since the pandemic began — at Wednesday’s meeting.

Celebrity Kim Kardashian has been кажњен са 1.26 милиона долара by the SEC for touting a crypto without disclosing she received a payment.

Тесла

ТСЛА,

reported record quarterly deliveries on Sunday. but the number still disappointed analysts. Shares are down over 4%.

Цредит Суиссе акције

ЦС,

ЦСГН,

is slumping after troubling headlines about the Swiss bank’s health following a rise in credit-default swaps on Friday.

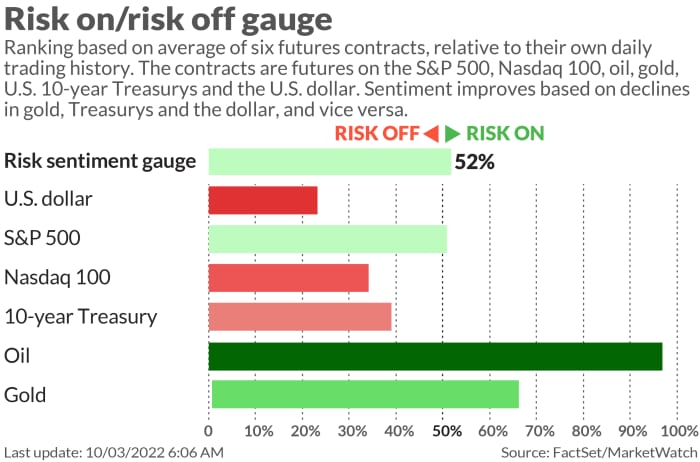

Citigroup lowered its end 2022 S&P target to 4,000 (from 4,200). They see a risk-on rally in the final quarter, driven in part by beaten down sentiment.

A big week for data ends with nonfarm payrolls. For Monday, the Institute for Supply Management’s manufacturing index was the weakest number in 28 months, while construction spending fell more than expected. Auto sales and a speech from New York Fed President John Williams also are on the docket.

Two ruptures on Europe’s Nord Stream pipeline appear to have stopped leaking natural gas, say Danish authorities. But a global energy body has warned Europe faces an “unprecedented” shortage of natural gas this winter, if it doesn’t cut usage by 13%.

Најбоље на вебу

Indonesia awash in grief after soccer stampede kills 125, injures hundreds

Russian soldiers with “empty eyes” barely escaped Ukraine city of Lyman

Amid war, nuclear threats and famine, here comes Nobel Prize season

Графикон

Our chart from Матт Фок, founder/president of Ithaca Wealth Management, discusses important levels to watch on the S&P 500. It was flagged in The Chart Report (Х / Т Хауард Линдзон), who had this to say:

“Matt points out that it’s currently testing its 200-week moving average for the first time since the pandemic. We actually closed slightly below it today [Friday], so buyers will need to show up soon if we’re going to have a 2011 or 2018 scenario. If we extend below it, it will be a major red flag. Either way, keep an eye on how this test plays out in the coming weeks,” said the Chart Report.

Тикери

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern time:

| Срце | Сигурносно име |

| ТСЛА, | Тесла |

| ГМЕ, | систему ГамеСтоп |

| АМЦ, | АМЦ Ентертаинмент |

| ААПЛ, | јабука |

| НИО, | нио |

| АВЦТ, | Америцан Виртуал Цлоуд Тецхнологиес |

| БББИ, | Бед Батх & Беионд |

| ТВТР, | |

| ДВАЦ, | Стицање дигиталног света |

| ЦС, | Цредит Суиссе |

Насумична читања

Fastest marathon as a vampire and 17 more Guinness Records broken in London

The small device stopping water waste by LA’s wealthiest

Треба знати рано и ажурира се до почетног звона, али Пријавите се овде да бисте је једном испоручили на вашу е-пошту. Верзија е-поштом биће послата око 7:30 ујутро по источном.

Слушајте тхе Најбоље нове идеје у подкасту новца са репортером МаркетВатцх-а Чарлсом Пасијем и економисткињом Стефани Келтон.

Source: https://www.marketwatch.com/story/heres-a-big-tech-name-to-put-on-your-shopping-list-and-how-to-buy-it-even-if-the-bear-market-is-far-from-over-11664794389?siteid=yhoof2&yptr=yahoo